Corporate Bond Market Event Studies: Event-Induced Variance and Liquidity

Image credit: Kevin Riehl

Image credit: Kevin RiehlAbstract

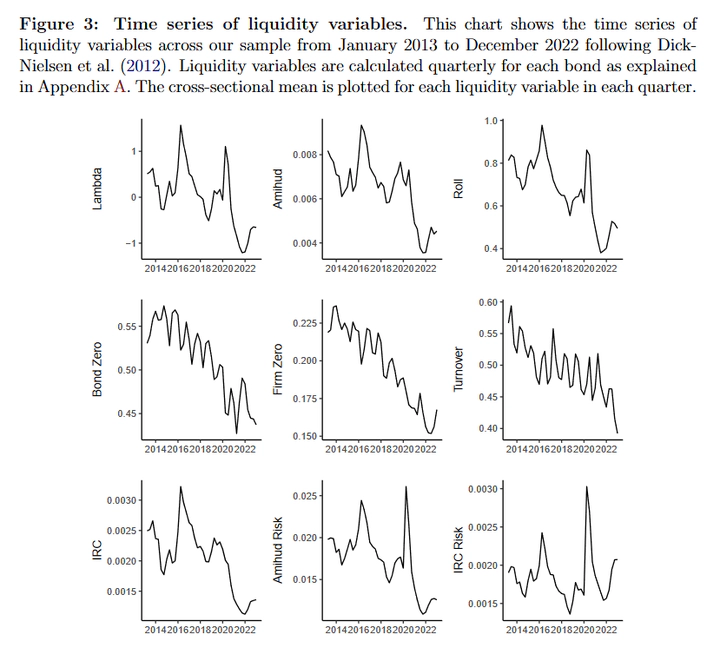

This paper addresses the power of event studies in corporate bond markets. While an approach using standardized abnormal returns is well specified under standard conditions, we identify two market phenomena negatively impacting the informative value of results. In particular, we show that test power decreases rapidly in the presence of event-induced variance. Moreover, illiquidity becomes a material concern when the samples are geared towards above-average maturities and credit risks. Therefore, we suggest a refinement to the current standard approach and provide open-source tools to implement event studies.

Type

Publication

Preprint in SSRN