Do acquirers care about credit rating consequences? Evidence from credit rating watches

Image credit: Kevin Riehl

Image credit: Kevin RiehlAbstract

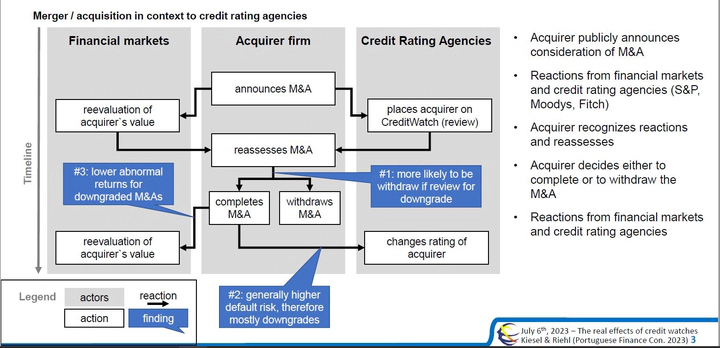

We analyze corporate acquisition announcements and the feedback of credit rating agencies by placing the acquirer’s issuer rating under formal review for a potential change. We show that acquisitions are 42.8% more likely to be withdrawn if the firm’s rating is placed on review for downgrade. Focusing on completed acquisitions, deals associated with reviews for downgrade need approximately 40% more time to be completed, and acquirers are twice as likely to be downgraded in the first year (13.4% versus 25.2%). The stock market considers the probability of an acquirer’s downgrade as deals with increased downgrade risk show lower abnormal announcement returns. We do not find evidence that reviews of rating agencies are anticipated by firms.

Type

Publication

The British Accounting Review